|

|

|

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gap Auto Warranty: Coverage Guide for U.S. ConsumersIn the bustling world of vehicle ownership, U.S. consumers are constantly exploring ways to protect their investments. One such avenue is the gap auto warranty, a valuable tool that offers peace of mind and financial security. Let's dive into what a gap auto warranty is, how it can save you money, and why it might be the right choice for you. Understanding Gap Auto WarrantyA gap auto warranty is designed to cover the 'gap' between your car's depreciated value and what you owe on your auto loan. This type of warranty is particularly beneficial for those who are leasing or have financed a vehicle with a small down payment. Imagine driving through the busy streets of Los Angeles, knowing that even in the event of an unexpected accident, you won't be financially stranded. Key Benefits

What's Covered?Gap auto warranties typically cover the difference between the insurance settlement and the outstanding loan amount. However, it's crucial to read the terms carefully, as coverage can vary. For example, if you're in New York and your car is declared a total loss, the gap warranty ensures you don't pay the remaining balance out of pocket. ExclusionsIt's important to note that gap warranties do not cover:

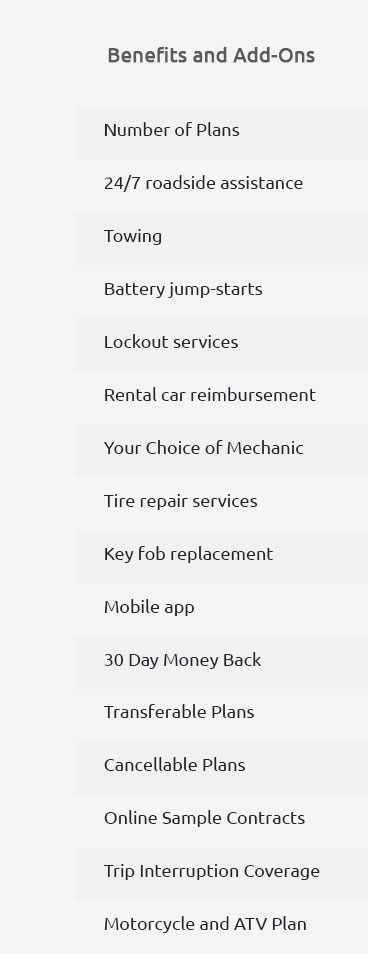

Comparing OptionsWhen selecting a gap auto warranty, it's wise to compare different providers. Consider checking out auto repair insurance companies for a comprehensive list of providers and options tailored to your needs. Cost ConsiderationsGap auto warranties can vary in price based on your vehicle type, loan term, and provider. The investment can be minimal compared to the potential cost of covering a loan gap after an accident. Many U.S. consumers find that the peace of mind provided far outweighs the cost. Is It Worth It?For those who have financed a new car with little to no down payment, such as in a bustling city like Miami, a gap warranty could be a lifesaver. It ensures that your financial stability isn't compromised in the event of a loss. FAQs About Gap Auto Warranty

By understanding the benefits and coverage of gap auto warranties, U.S. consumers can make informed decisions that provide financial protection and peace of mind. https://allincu.com/service/gap-and-warranty.html

Count on All In to not only finance your vehicle, but to help you insure and protect your purchase. We offer GAP coverage and Extended Warranty Mechanical ... https://www.members1st.com/gap-extended-warranty/

Consider these coverage options to give you peace of mind. Guaranteed Asset Protection (GAP) Extended Warranty Contact us today to add these coverages! https://www.globalwarranty.com/products/gap/

Cover your assets - New and used cars, including leases - Loans up to $125,000 - Coverage up to $50,000 - Optional Car Rental, Insurance Deductible and Customer ... Other Available Options

|